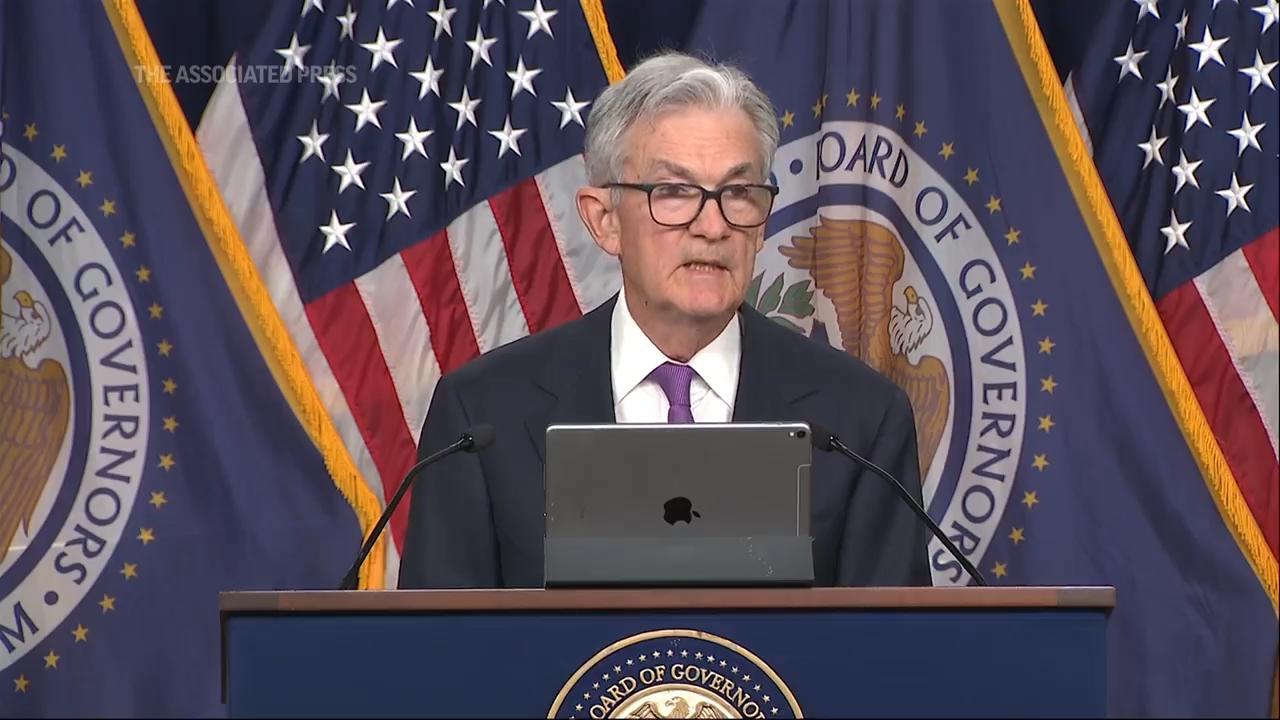

Fed retains charges unchanged however indicators attainable hike this yr to struggle inflation

Fed retains charges unchanged however indicators attainable hike this yr to struggle inflation

AP

Inflation pressures have been displaying up within the office, and never solely in calls for for pay will increase.

Many workers additionally wish to their corporations to offer different sorts of assist coping with the rising price of dwelling, reshaping the sorts of advantages being requested and supplied.

Conventional retirement plans and well being/dental insurance coverage stay an important foundational advantages that corporations provide, serving to workers meet their long-term monetary objectives. However a newer focus has been on packages that may help employees in dealing with short-term challenges which have been exacerbated by the inflation spike of the previous two years.

“Retirement preparedness and healthcare prices have been the principle focus,” stated Craig Copeland, director of wealth-benefits analysis on the Worker Advantages Analysis Institute, talking at a convention hosted by his group. “However given the persistence of excessive inflation, employers have actually tried to step up with monetary well-being packages that assist individuals perceive easy methods to save and spend.”

In a latest EBRI research, the roughly 1,500 employees who had been surveyed reported feeling extra stress over increase emergency financial savings and paying month-to-month payments than saving sufficiently for retirement, the standard prime supply of monetary anxiousness.

Budgeting, emergency funds and managing debt

Employees who take part in 401(okay) retirement plans typically can take out momentary loans towards their balances, and these accounts typically are their largest monetary asset. However borrowing repeatedly from 401(okay) accounts often isn’t one of the simplest ways to go, for varied causes equivalent to getting out of the financial savings routine and probably halting employer matches.

Making everlasting withdrawals is even worse, as they often set off present taxes and, probably, a penalty.

That’s why separate saving packages designed to assist workers meet emergency and different unanticipated short-term wants have develop into extra fashionable as a office profit choice. So, too, for packages that assist employees study budgeting and different subjects equivalent to coping with credit-card money owed.

Some employers provide financial help, prizes for assembly objectives, reductions, short-term loans or different incentives to encourage participation. The businesses probably to supply these and different advantages are giant ones, with smaller employers sometimes effectively behind the curve.

Many employers may not view themselves as being answerable for offering monetary training to their workers, however extra appear to be accepting the problem.

“Lots of people don’t know easy methods to handle a price range or how essential it’s to stay to a price range,” stated Lisa Margeson, a managing director of retirement analysis at Financial institution of America and one other convention speaker.

Budgeting and studying easy methods to handle credit-card money owed are among the many modifications that may assist individuals take care of financial uncertainty, she stated. Financial institution of America’s personal analysis confirmed two in three customers are involved about maintaining with inflation, and 7 in 10 report being extremely burdened about their funds, she stated.

What American Dream? How youthful employees are redefining success

Close to-term issues vs. long-term aims

Given the near-term challenges equivalent to these posed by increased inflation, many employees doubtless are neglecting longer-term aims like saving usually in a 401(okay) retirement account.

“Sixty p.c of the workforce resides paycheck to paycheck,” stated Jeff Miller, a vice chairman at Nudge International, a monetary training firm, who additionally spoke on the convention. “They don’t care about (long-term) monetary plans; they’re making an attempt to outlive.”

Different stress-reducing advantages that may make a giant distinction for some employees embrace caregiver leaves of absence, versatile scheduling and even menopause help, Margeson stated. That final class contains entry to menopause well being specialists, insurance policies equivalent to day off/versatile work preparations when wanted and hormone-replacement remedy coated by medical health insurance plans.

Audio system on the EBRI convention reported a common disconnect between the advantages that employers provide and what employees suppose is obtainable, elevating the necessity for better worker consciousness.

The upcoming open-enrollment season, that interval towards year-end when employers permit employees to pick out new advantages and cancel others, presents an opportunity to make enhancements.

However that assumes persons are finding out the alternatives or are even conscious of them, which isn’t at all times the case. Bigger employers surveyed by EBRI provide about 5.5 monetary wellness advantages on common, however there are at the very least 16 pretty frequent ones, together with a number of mentioned above, and too many decisions may be complicated.

Advantages decisions throughout open enrollment

Employees on common spend solely about 18 minutes on their open-enrollment decisions, with most of that point dedicated to analyzing healthcare plans, Miller stated. That’s why he and different audio system on the convention urged corporations to attempt to preserve elevating consciousness about advantages all year long.

Employers may not really feel it is as much as them to offer monetary training for his or her employees, however the payback can embrace extra glad employees, lowered absenteeism, higher worker retention and a neater time hiring new workers.

Productiveness can also enhance. Within the EBRI survey, 54% of worker respondents stated monetary issues distract them at work. A whopping 88% stated they’re very or considerably involved that sustained excessive inflation will have an effect on their funds. The survey was principally performed in July when U.S. inflation was working at a 3.2% annual tempo.

“Employers underestimate the affect (of monetary stresses) on the workforce fairly considerably, and lots of workers aren’t conscious of all what their corporations provide,” Margeson stated.

Attain the reporter at russ.wiles@arizonarepublic.com.