In keeping with Freedman, the group obtained (and rejected) a latest non-public fairness provide at 15 instances EBITDA, a metric that reached $106 million in 2020-21 earlier than pandemic provide chain bottlenecks diminished it to $82 million in 2021-22. A 15-times a number of would indicate a valuation for Mackie of $US225 million ($337 million).

Shopping for Mackie additionally represents a return to Mr Freedman’s roots, offering the general public tackle methods for bands within the rough-and-tumble bars and golf equipment of Eighties Sydney.

‘Bands and buskers’ market

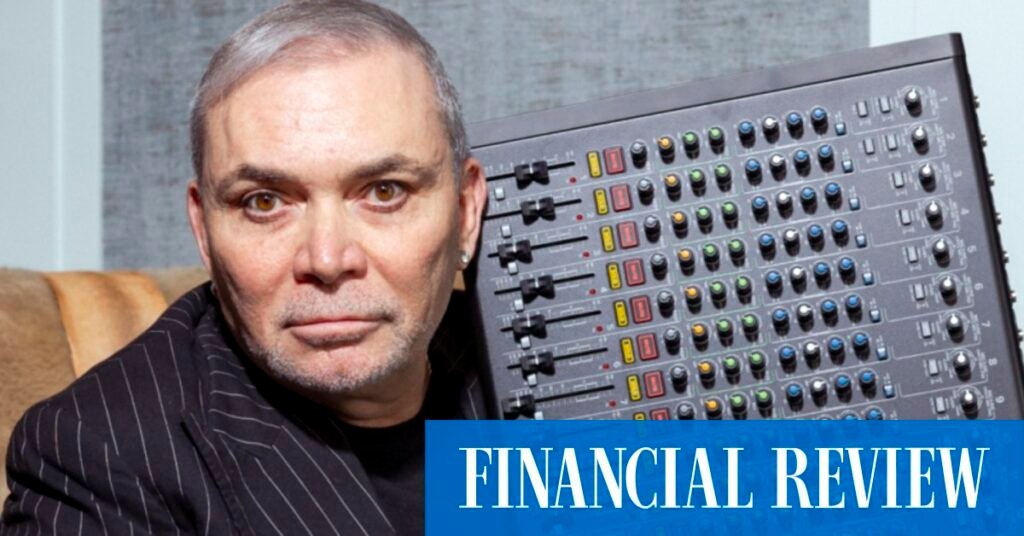

The 65-year-old made his fortune, estimated at $1.35 billion on this yr’s Wealthy Record, manufacturing and promoting microphones and different house audio gear, together with a podcast mixing console that proved wildly standard throughout the pandemic.

Nonetheless, the household enterprise was began by his father Henry in 1968 as an installer of sound methods in venues comparable to Kings Cross’s Chevron Resort and Souths Juniors Rugby League Membership, a convention Peter Freedman continued on the latter in 1985 by establishing Bunnies nightclub.

Mackie’s stay mixers and loudspeakers put Mr Freedman firmly again in what he calls the “bands and buskers” market, which he sees aligning with Rode’s “content material creator” prospects who need well-built gear at approachable costs.

“Each manufacturers helped gasoline the democratisation of DIY recording in their very own means,” he stated.

“And the stay music factor is coming again like loopy in every single place, so it’s good.”

In a decent expertise market globally, Freedman stated the addition of Mackie’s 85 workers – nearly all of them audio engineers – to Freedman’s 500-plus headcount was additionally engaging.

Mackie, which has been owned by Californian non-public equiteers Transom Capital since 2017, oversees contract manufacturing of its gear in Shenzhen.

Mr Freedman stated a few of that exercise could be shifted to Rode’s superior manufacturing hub in Sydney, which has 26,000 sq. metres of factories and warehouses in Silverwater and Greystanes, and housing precision equipment valued at greater than $500 million.

“With the set-up we’ve bought right here, there’s lots of issues we are able to do cheaper than China,” he stated.

Nonetheless, he stated the Shenzhen facility, established within the early 2000s, could be retained and there have been alternatives to ship some Australian-made parts there to be assembled at scale.

Mr Freedman and his group chief govt, Damien Wilson, noticed sufficient synergies in Mackie to finish the deal unusually rapidly. Wilson stated the preliminary electronic mail from Transom hit his inbox solely on August 17.

“It helped that it was type of our second rodeo,” Mr Wilson stated, after Rode did due diligence and positioned itself for a unique acquisition a yr in the past, which finally didn’t get accomplished.

Former treasurer and Rode director Joe Hockey stated it was “thrilling to see Rode proceed to spend money on their future.”